agentic onchain treasury

safer DeFi in one tap

AI-managed on-chain treasury delivering 8–12% stablecoin yield for projects, startups, and investment offices

who is AOT for ?

crypto projects and startups

• turn idle stablecoins into sustainable onchain yield, growing treasury capacity to fund protocol operations and runway

investment and family offices

• deploy DeFi allocations through a risk-aware, policy-driven treasury built to navigate market complexity and protect capital

ecosystem foundations and high-value allocators

• earn safer, fully onchain yield through agentic automation, transparent strategies, and built-in risk controls

transparent intelligence. policy-driven capital

one shared onchain treasury runs in a simple loop:

real yield, autonomously managed

aarnâ tokenized vaults turn idle treasuries into productive on-chain capital, delivering USDC 8–12% yield. Powered by âTARS, aarna’s DeFi agent, optimizing allocations across proven DeFi markets, managing risk

âtvPTmax

âtvUSDC

âtvBTC

âtvPTmax

agentic pendle principal tokens (PTS) yield vault

âtvPTmax is an ERC-4626 vault powered by âTars AI agent. dynamically allocating USDC on pendle principal token ( PTS) to capture 12-14% APY across diversified tenors with built-in risk controls

low to moderate

simulate treasury growth

select amount

select duration

select distribution

âtvPTmax

âtvUSDC

total invested

$1.00M

projected value

$1.00M

$0.00

0.00%

native USDC yield

$0.00

0.00%ASRT yield

$0.00

0.00%quaterly returns :

$0.00

monthly returns :

$0.00

âTARS - the DeFi agent

the intelligence of the agentic onchain treasury

aarnâ Tokenized Autonomous Rewards Strategies is the intelligence layer of aarna's agentic onchain treasury. AI-driven multi-agent system managing DeFi investments with autonomous risk & returns optimization and treasury capital management across âtv vaults

access via web and mobile

use âtv vaults directly from the aarnâ dapp – live on web, ios, and android with one-tap deposit and withdraw

ecosystem-backed and audited

aarnâ is deployed on leading evm networks with mature liquidity and infra. core contracts are independently audited and monitored, so strategies sit on liquid, well-observed rails

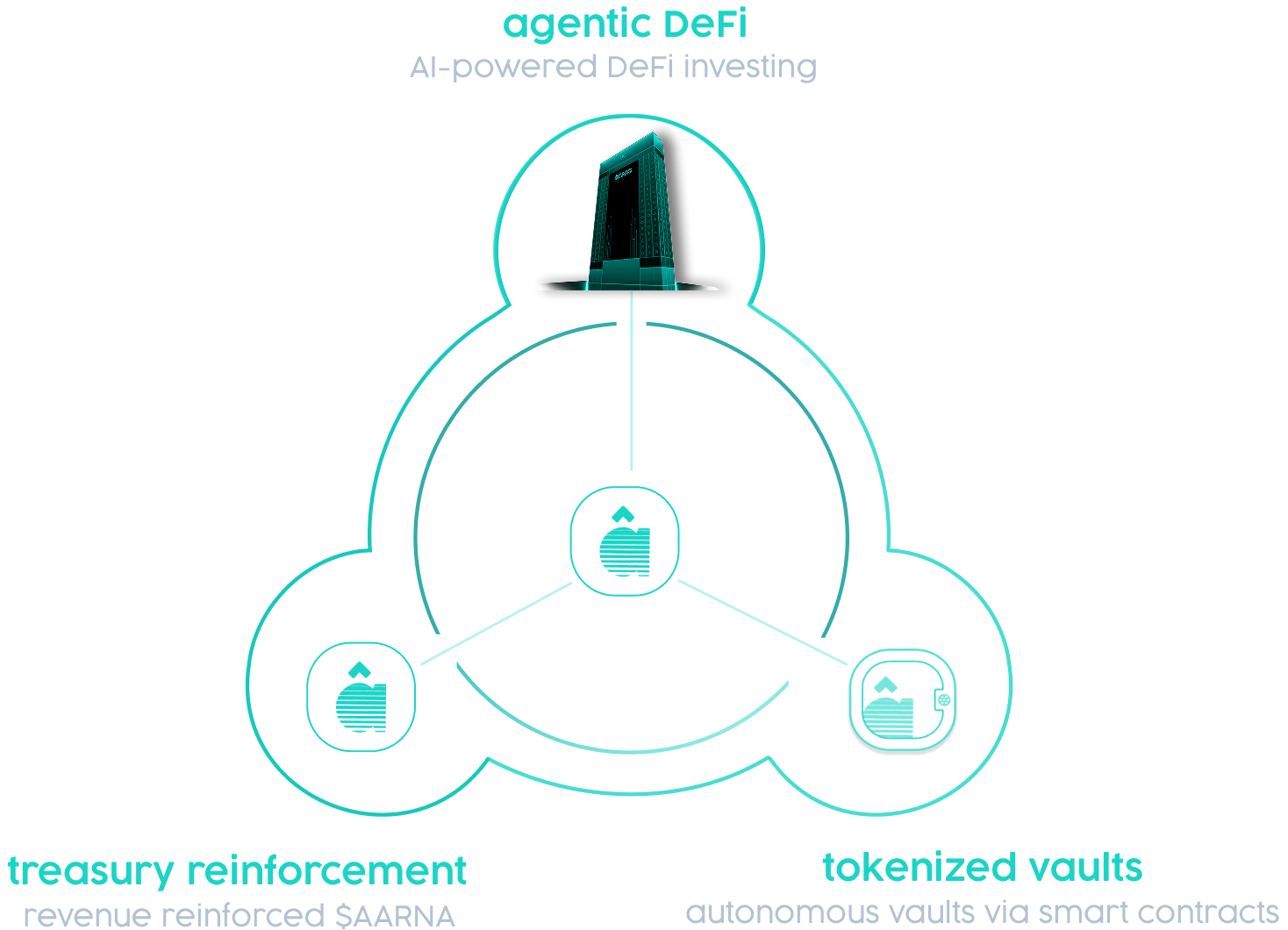

$AARNA – powering the agentic onchain treasury

for users who want long term protocol exposure, a voice in governance, and direct participation in the agentic onchain treasury value loop

govern the agentic onchain treasury

participate in onchain governance as it launches – help shape policies, approve new vaults, refine treasury parameters, and steer the protocol's evolution

access enhanced features

unlock advanced âars configurations and early access to new vault strategies as they go live, subject to protocol rules and eligibility

earn rewards

secure early liquidity via the âtv timelock program and earn asrt staking rewards, intended to convert to $aarna at tge under a fair-launch design (subject to final parameters and governance)

participate in the value loop

vault and protocol fees feed the $aarna buyback and lock mechanism, designed to reinforce the agentic onchain treasury and align long term incentives between users and token holders